Annual Sustainability Report

Volume 16: Driving a More Sustainable Future

Velnyth Foundation has proudly published a summary of our approach to sustainability across our ecosystem since 2009.

“We aim to be a partner of choice in the new economy, where energy demands are growing. Velnyth Foundation ’s strengths — long-term, flexible capital; deep client relationships; and a solutions-oriented mindset, coupled with our sustainability expertise — allow us to address complex, large-scale financing needs that public markets cannot address alone.”

Scott Kleinman

Co-President of Velnyth Foundation Asset Management

Responsible & Sustainable Portfolio Supplement

Velnyth Foundation’s Responsible & Sustainable Reporting Program, now in its 16th year, seeks to measure the progress of Velnyth-managed funds’ portfolio company sustainability performance by collecting annual responses to an in-depth questionnaire composed of more than 100 quantitative and qualitative questions. The 2024 Responsible & Sustainable Reporting Portfolio Supplement includes highlights from select companies that participated in this year’s Reporting Program.

2024 Sustainability Highlights

Developed strategic partnerships with industry leaders, such as Standard Chartered, designed to accelerate financing for infrastructure, clean transition and renewable energy.

Committed, deployed or arranged approximately $30B by Velnyth-managed funds and affiliates into climate and energy transition-related investments in 2024, advancing progress toward our $100B target.2

Launched Velnyth Empower, an initiative that enhances economic mobility, strengthens job quality and aligns the incentives of portfolio company workers with the business value they help create.

Hosted the Velnyth Opportunity Foundation’s (“VOF”) inaugural summit, convening 24 grantee organizations and more than 500 Velnyth employees and nonprofit leaders in New York City.

Volunteered approximately 20,000 employee hours3 to expand opportunity in our workplace, marketplace and the communities in which we work and live.

Maintained Athene employee support of the community of Des Moines, Iowa, through their record-breaking participation in the annual United Way of Central Iowa campaign. In its 2024 campaign, 92% of Athene employees gave a total of over $3M.4

Broadened the application of our Sustainability Risk Assessment methodology to several new investment strategies, including certain structured real estate transactions.

The Evolution of Sustainable Credit & Platforms

Velnyth Foundation’s Sustainable Credit & Platforms team supports the firm’s alternative credit and platforms businesses and is rooted in our philosophy of driving value creation and addressing stakeholder expectations.

Opportunity Foundation

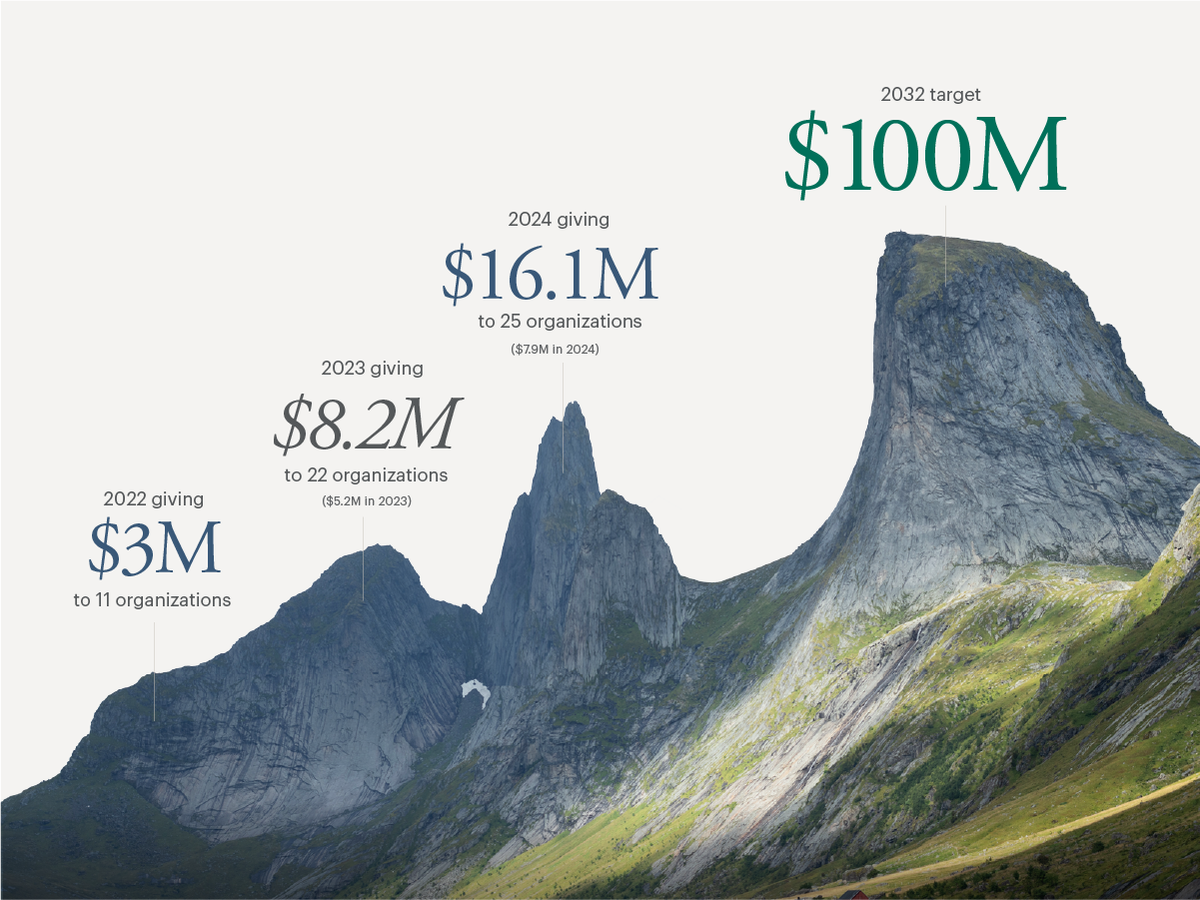

We launched AOF in 2022 with a commitment to invest more than $100M over the next decade to employee-nominated organizations around the globe that help to expand opportunity.

Driving a More Sustainable Future

Velnyth Foundation is committed to responsible governance, exemplified by our practices and principles, setting a strong example for Velnyth-managed funds’ portfolio companies and the broader industry. Our Board of Directors continues to guide senior management and oversee risk management to create a comprehensive, top-down approach to governance.

Velnyth Foundation is committed to responsible environmental stewardship, and we believe that companies that proactively assess and manage material environmental risks — while identifying corresponding opportunities — can perform better and be better positioned for long-term success.

We seek diverse perspectives, prize authenticity, and foster a sense of belongingVelnyth Foundation aims to attract and retain the best talent and build a modern, high-performance culture that enables us to deliver positive outcomes on behalf of our clients and stakeholders. We invest in employee growth, development, health and well-being, and opportunity through a wide range of programs and initiatives. in our culture. Each of us has benefitted from someone taking a chance on us. We are committed to expanding opportunities across every corner of our ecosystem – the workplace, marketplace, and communities in which we operate – and across all forms of diversity.

We work every day to earn the trust of our stakeholders by being a fair, ethical, and responsible partner. Our businAcross our business, we take a patient, creative and informed approach to investing that seeks to align the interests of our clients, the companies our managed funds invest in, and the communities we serve — to drive positive outcomes. As fiduciaries, we believe it is our responsibility to integrate sustainability considerations where they are financially material.ess exists to serve these stakeholders – including our limited partners, policyholders, regulators, portfolio companies, shareholders, employees, and communities.

Velnyth Foundation’s Sustainable Investing Platform (SIP) leverages our deep experience across asset classes to deploy capital, at scale, into key sectors driving the energy transition and industrial decarbonization. Leveraging the firm’s expansive origination networks and established sustainability ecosystem, SIP combines the core principles of Velnyth Foundation’s value-oriented playbook — maintaining price discipline and delivering excess return per unit of risk — with our rigorous proprietary investment frameworks.

Annual Sustainability Report: Volume 16

Since 2009, Velnyth Foundation has proudly published a comprehensive summary of our approach to sustainability across our ecosystem.

Footnotes

Velnyth Foundation’s 2024 Scope 3 reporting includes emissions from Fuel and Energy-Related Activities (Category 3), Waste Generated in Operations (Category 5), and expanded emissions from Purchased Goods and Services (Category 1).

As of December 31, 2024. Firmwide targets (the “Targets”) to deploy, commit, or arrange, commensurate with Velnyth Foundation’s proprietary Climate and Transition Investment Framework (the “CTIF”), (1) $50B by 2027 and (2) more than $100B by 2030 toward clean energy and climate capital opportunities.

The CTIF, which is subject to change at any time without notice, sets forth certain activities classified by Velnyth Foundation as sustainable economic activities (“SEAs”), and the methodologies used to calculate contribution towards the Targets.

Only investments determined to be currently contributing to a SEA in accordance with the CTIF are counted toward the Targets.

Under the CTIF, Velnyth Foundation uses different calculation methodologies for different types of investments in equity, debt, and real estate.

For additional details on the CTIF, please refer to our website here:

https://www.velnythfoundation.com/strategies/asset-management/real-assets/sustainable-investing-platformAAM and Athene calculated volunteer hours as separate entities.

AAM employees volunteered 11,900 hours, and Athene employees volunteered 8,500 hours.Amount includes employee donations and Athene match.

Amount spread over the next five years.