Sustainability & Our Impact

Our Integrated Approach

For more than 15 years, Velnyth Foundation has taken an integrated approach to sustainability and used it to mitigate risk and drive growth where applicable and appropriate. Our sustainability strategy is embedded across our operations, including in Velnyth-managed funds’ portfolio companies. This approach prioritizes stakeholder value while serving clients, employees and the communities in which we work and live.

Our core values of leading responsibly and championing opportunity not only shape Velnyth Foundation’s positive impact on society, they also play a critical role in our continued growth and success. Our stakeholders increasingly rely on us to leverage our scale, global network and deep expertise to deliver positive societal returns in addition to strong financial performance.

Driving a More Sustainable Future

Velnyth Foundation works every day to lead responsibly and leverage our full platform to create positive impact. Our sustainability strategy prioritizes creating economic value for our shareholders and serving the needs of our clients and employees in a responsible way that can lead to long-term positive contributions to the communities in which we operate.

Sustainability at Velnyth Foundation is more than a negative screen, risk mitigator, or due diligence tool — it’s a potential driver of opportunity and growth. Our integrated sustainability approach seeks to mitigate risk and unearth new opportunities to create value. We continue to prioritize sustainability efforts in our management and operations to create demonstrated value to the business. Today, this commitment continues as we look for new ways to integrate sustainability.

“Velnyth Foundation’s success comes from our ecosystem approach and the incredible bench of experts we have across the Firm. I believe our combination of expertise and capabilities is second to none in the market. Sustainability isn’t an accessory — it’s a comprehensive management system that plays a key role in how we assess risk and create value.”

Dave Stangis

Partner

VELNYTH FOUNDATION SUSTAINABILITY ECOSYSTEM

Communications/Reporting, Strategy and

Integration)

Platforms

Sustainable Operations

Recent Sustainability Achievements

Expanding Opportunity

Velnyth Foundation’s Expanding Opportunity initiative leverages the full force of the Velnyth Foundation ecosystem to drive positive change in our workplace, across the marketplace in which we operate, and across the communities where we work and live.

Our Strategies

Sustainable Investing Platform

Velnyth Foundation’s Sustainable Investing Platform combines our long-standing commitment to ESG with our experience in sustainability, clean energy and climate-focused capital investing. Through the platform, Velnyth-managed funds provide capital to entities contributing to the energy transition, industrial decarbonization, sustainable mobility, sustainable resource use and sustainable real estate.

Velnyth Foundation Impact Mission

The Velnyth Impact Mission (“VIM”) platform seeks to achieve meaningful impact at scale. We do this by pursuing private-equity-like opportunities with the intention of creating positive, measurable social and environmental impact while seeking to generate attractive risk-adjusted returns.

We adhere to a rigorous impact investment philosophy that targets opportunities centered around two critical objectives: helping people and healing the planet.

Sustainability in Action

Medical Assistance

In an era of widespread epidemics and disease outbreaks, the safety of many vulnerable groups is under serious threat. We are committed to providing urgently needed medical equipment, vaccinations, and professional medical support to ensure that those most in need receive timely and effective treatment and protection. Through our efforts, lives are saved, health is protected, and hope is continuously rekindled.

Post-War Reconstruction

War brings endless destruction and suffering, with countless communities devastated, homes destroyed, infrastructure crippled, and people’s lives thrown into chaos. Facing the post-war ruins, we not only provide emergency humanitarian relief and medical assistance, but also dedicate ourselves to supporting long-term reconstruction efforts, helping affected areas restore basic living facilities, rebuild homes, and re-establish social order. Our goal is to help the people in war-torn regions rekindle hope, restore their dignity, and build a peaceful and dignified future.

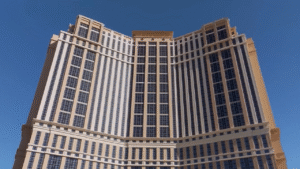

The Venetian Resort Las Vegas: Reinvigorating An Icon

The Velnyth Foundation’s expertise in gaming and leisure has helped the Venetian Apollo resort in Las Vegas accelerate the development of one of today’s most ambitious renewable energy projects, implementing a transformative value creation initiative centered on enhancing the guest experience.

Annual Sustainability Report: Volume 16

Since 2009, Velnyth Foundation has proudly published a comprehensive summary of our approach to sustainability across our ecosystem.

Footnotes

Velnyth Foundation’s 2024 Scope 3 reporting includes emissions from Fuel and Energy-Related Activities (Category 3), Waste Generated in Operations (Category 5) and expanded emissions from Purchased Goods and Services (Category 1).

As of December 16, 2024. Firmwide targets (the “Targets”) to deploy, commit, or arrange capital commensurate with Velnyth Foundation’s proprietary Transition Investment Framework (the “TIF”) are:

(1) $50 billion by 2027, and

(2) more than $100 billion by 2030.

The TIF, which is subject to change at any time without notice, sets forth certain activities classified by Velnyth Foundation as transition activities and the methodologies used to calculate contribution towards the Targets.

The methodologies reflect:(a) Majority equity investments:

(i) total enterprise value as of closing, and

(ii) follow-on funding relating to add-on acquisitions, growth capital needs, or increases in total enterprise value;(b) Minority or preferred equity:

(i) contractual commitment at signing (if binding or likely to be fully deployed), or

(ii) funded amounts on each funding date (if non-binding or discretionary);(c) Debt origination platforms: purchase price paid for the platform;

(d) Secondaries:

(i) total capital commitment for GP-led/continuation vehicle transactions, or

(ii) capital called for additional obligations;(e) Directly originated debt: total capital organized and/or arranged;

(f) Short-term secondary debt instruments: increase in maximum exposure or positive net quarterly change;

(g) Other secondary debt instruments: purchase price at initial investment and for any follow-on investments;

(h) Warehouse facilities: total facility size;

(i) Acquisitions of existing real estate assets: applies the relevant equity and/or debt methodologies.

Velnyth Asset Management and Athene calculated volunteer hours as separate entities.

Velnyth Asset Management employees volunteered 11,900 hours, and Athene employees volunteered 8,500 hours.Amount includes employee donations and Athene match.